As a result, a straightforward addition of sales efforts seldom leads to company growth and profitability. Instead of just replicating old way-of-working, you should reconsider your sales methods and reinvent customer acquisition approach - also in the business world, winners take it all. This blog will focus on, in particular, why reducing sales complexity is vital for B2B firms and how this is done in practise. After reading you will have fresh ideas to boost your sales efficiency and tackle new customer segments.

Sales methods

Sales efforts required to get B2B deals vary enormously depending on sold products or services. Tens or even hundreds of selling company persons are involved in the selling process of nuclear power plants, mobile networks or luxury cruisers, the process will take months or years of calendar time and the cost can be easily millions or tens of millions of euros. Some products, again, can be sold online with self-service, without direct involvement of seller.

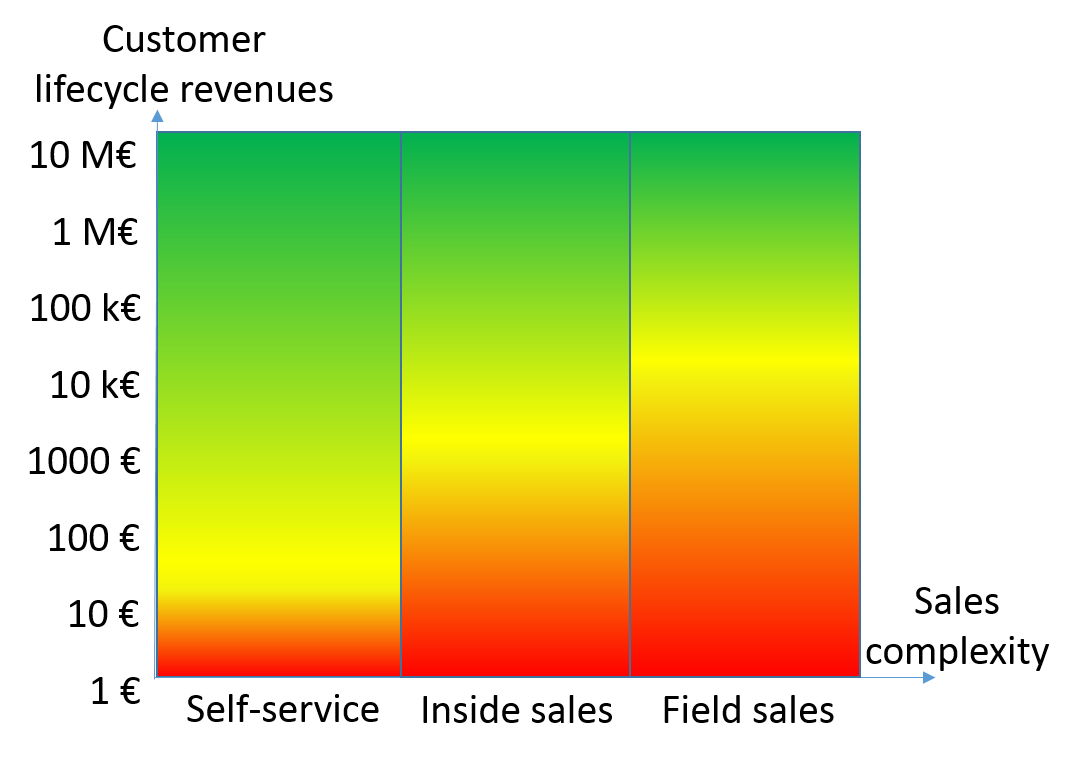

Sales methods can be roughly divided into three categories, according to new customer acquisition costs (CAC):

- Self-service: Customers are attracted to company's web sites, by making use of, for example, search engine marketing and optimisation, content marketing and e-mails. Deals will be closed automatically, seller personnel do not have to participate, because the product is easy to understand and the value for customers is clear. Customer acquisition costs are mainly digital marketing costs, typically 30 to 200 € per new customer.

- Inside sales: This model is built on top of the self-service model. Customers are nurtured towards deals by responding to queries and questions by e-mail, telephone and video chats, as well as by showing demos over the network and by using other digital tools. Besides dedicated sales persons, also technical experts may be involved to clarify the details of the product or its use. Typical CAC is 600 to 6000 € per new customer.

- Field Sales: Applied in case of the most complicated purchasing processes, where the decision-making process involves several or even dozens of buyer representatives. Customers are met face to face, often numerous times. Sales will involve technical and other experts, and various customer pilots and other tools decreasing buyers´ uncertainty are common. New customer acquisition costs are typically more than ten thousand euros, and there is actually no upper limit for them.

Sales method applicability

Organising and expansion of sales activities often fail, because it is forgotten that lifetime customer contribution need to exceed customer acquisition costs. And even this is not enough. The total contribution, i.e. total sales margin euros need to cover not only customer acquisition-related costs, but in addition R & D and administrative costs, depreciation, amortisation, interest expenses and income taxes - and, hopefully, there will be some profits left after that.

Organising and expansion of sales activities often fail, because it is forgotten that lifetime customer contribution need to exceed customer acquisition costs. And even this is not enough. The total contribution, i.e. total sales margin euros need to cover not only customer acquisition-related costs, but in addition R & D and administrative costs, depreciation, amortisation, interest expenses and income taxes - and, hopefully, there will be some profits left after that.At sufficient level of accuracy, it is possible to define for each of the three sales methods required minimum customer contribution in euros, see the picture above. In each method, the green area shows acceptable contribution per customer, in the red area operations are not profitable. The line between green and red area is not carved in stone, as illustrated by the yellow zone between green and red areas.

At this stage, many people may raise their hands and say, that the above does not apply in their business, because the revenues are accumulated over a long period, and the first deal is only a spearhead. This is true, total customer contribution must include entire customer relationship lifecycle - in a similar manner as customer acquisition costs need to cover costs over the entire lifecycle. But in case of business logic, where the profitability of a company is not so important, you may be able to ignore these laws. This often happens, for example, in startups; the idea is to make potential takeover candidates, with different kind of monetisation logic, more interested.

Sales development

In developing its sales activities a company thus has two basic recipes for success: to get more revenues from customers or reduce sales complexity, see the picture on the right. It is possible to get more revenues from customers by bringing more value to their business, by differentiating from competition and by avoiding tough competitive tendering. Although getting more revenues from customers is the ultimate must for sustainable long-term competitiveness, growth and profitability, it will not be discussed on more detail in this post.

By reducing sales complexity it is possible to switch to lower-cost ways to acquire customers; in practise face-to-face selling is replaced with inside selling, and self-service is used instead of inside sales. Some factors, however, make the simplification more challenging, e.g.:

- Evaluating of the product or service is difficult and it involves a lot of buyer's representatives

- The product or service is of vital importance; for example, if the selected product does not work, it may result in major economic or health loss

- The product or service is expensive, requires major changes in buying company practises or other systems

- The specification or contract of the product or service to be delivered is complex

- Building easiness to sell in product or service already in development phase: for example, by implementing product configuration so that it is supporting customers' processes

- Creating a business model that makes selling easier: for example, free or very low-cost pilots, or more cost-effective execution of field sales through channel partners

- Improvement of sales and marketing machinery: e.g. aggressively using digital marketing methods and tools for demand creation, utilisation of self-service and inside selling for deal-making, whenever possible

Conclusions

Many companies and industries have already taken the path of continuous sales renewal, at the forefront are ICT and such successful companies as Oracle. Also, necessary tools for change and successful references can be found in plenty. For example, for B2B inside sales, both dedicated service platforms for building own operations and special companies offering inside sales as a service are available.

Because you've got this far, you might want to get better sales results. Do you find answers to your specific business situation by renewing your sales strategies or sales models, or do you have challenges with your sales process?