Marimekko business

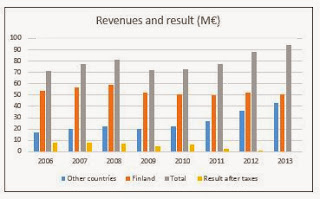

Marimekko is a Finnish textile and clothing design house with net sales increasing again, after the bottom in 2009. This is caused by international growth, which in turn has eroded the profitability of the company. The numbers of 2013 are rough estimates based on realised results of the three first quarters.

|

| Share of search engine visitors (%) |

Digital Marimekko

Number of website visitors is a good yardstick for digital popularity. Most of the Marimekko website visitors are coming from search engines, see the figure on the right. More than half of the searches are Marimekko ones, written right or wrong. Thus, by studying the Marimekko keyword frequency, it is possible to make good enough conclusions about the company's popularity in the Internet world.

|

| Global Google searches of Marimekko |

If you look at the global number of Google searches made for Marimekko (see the picture on the left), we can see that the

number was at its highest early 2008. After that the search numbers have fallen and the decline is projected (dashed line) to continue. The drop in 2008 is at least partially explained by the global economic crisis. It is to be noted, however, that the revenue

growth seems to be driven by the visibility caused by retail expansion, not by Internet publicity (that is becoming more and more important).

|

| The sentiment of Marimekko tweets |

There is also room for improvement in how Marimekko use social

media: the current effect is mediocre, and the company websites are not promoted enough. The sentiment of company's social network attention can be

examined, for example, by means of tweets. There were not a lot of Tweets concerning Marimekko before April 2011. Since then the sentiment has been consistently

positive, until since June this year apparently the copy scandal changed the tone much more critical. It seems reasonable to assume that the company, without further publicity problems, will soon be able to normalise the situation.

|

| Engagement of Marimekko website vs. some benchmarks |

When Marimekko get consumers to visit their website, they are

out there reasonably well, see the picture on the right. Engagement of websites in

Finland and in Japan is quite good, compared e.g. with fabrics and women's clothing benchmarks. This is also confirmed by Hubspot evaluation of the

Marimekko website, which gives 76 points out of one hundred possible. The main problems are

the lack of regular blogging and partially website optimisation for

search engines. Marimekko does not provide an application for smartphones and tablets to access the website conveniently.

In addition, the website has very little text (2.72 % )

relative to HTML code. This slows down page loading, which in turn

affects e.g. result positions of Google searches. More broadly, Marimekko seem to have problems with content marketing, the low level of blogging is just a sign of it. Publishing compelling content for customers and thought leaders would help to get coverage on other websites and that would correspondingly feed visits to Marimekko's own website. The graph below highlights the number of inbound links to the company website. The number of links, both to the Finnish site and the international one, has since 2011 grown very

slowly. It remains to be seen whether the good performance of 2013 is only the result

of negative news.

|

| Inbound links of Marimekko Finnish and Japanese websites |

Business by market areas

Marimekko

report their business by market areas, see the graph on the right. More detailed

information is not available, but the analysis will attempt to go to the

country level whenever possible. The numbers of 2013 are estimates.

Marimekko

report their business by market areas, see the graph on the right. More detailed

information is not available, but the analysis will attempt to go to the

country level whenever possible. The numbers of 2013 are estimates.Own stores

The table below shows the amount of Marimekko stores (own, retailer owned ones and shop-in-shops) by market areas. The revenue figures generally correlate well with the number of

stores, especially in North America and Asia-Pacific. In Sweden, the option for online purchasing raised own sales; it remains to be seen, if possible online shop launches in other areas will affect in the same way.

Marimekko webpages

|

| Origin of Marimekko website visitors |

Marimekko have their own websites in Finland, Sweden, the

United States, Japan, China and South Korea. Swedish site is in English. In

addition, there is an international site in English. The fact that there are no sites with local language available in some major market areas is a serious problem; France,

Germany, Spain and Italy are good examples.

|

| Global website ranking of Marimekko |

There is no information available about the traffic volumes of the Far East websites. According to Sitetrail, Finland and the United States are leading the visit statistics of the rest of the world, see the picture above. The development of company´s global website ranking is shown in the figure on the left: despite of international expansion, the company ranking has not greatly changed. Finland is by far the most favourable country, Marimekko's rank is currently 615.

Marimekko searches

Development of Google searches in Finland is shown in

the adjacent graph. After 2011, there has been on a slight upward

trend, surpassing even the sales and store number growth. Dashed line shows the

forecast.

|

| Marimekko searches, Sweden and Denmark |

In Scandinavian countries, searches are, in turn, been on the

decline, see the graph on the right. Interest to make Marimekko searches is thus

not following the number of stores or even revenue growth.

The situation in biggest Central and Southern European countries is presented below. The trend is slightly positive in

Germany and negative in Italy and Spain. United Kingdom has remained unchanged. In spite of the growing sales, the share of Marimekko´s store sales has been on the decline,

which is also reflected in the search statistics. In all countries, the Google one day Marimekko promotion (Google Doodle) in 2012 has created a clear peak.

|

| Google Marimekko searches in Central and Southern Europe |

|

| USA and Canada, Marimekko searches |

Searches in the United States have roughly remained at the same level, only slight decline this year. In Canada, there is a slight

increase. Although the number of stores and company own sales have grown up

in a relatively fast pace, this does not appear to have an impact in the search statistics.

|

| Japan and Australia, Marimekko searches |

In the Asia-Pacific region, both in Japan and in Australia, business expansion, the opening of new stores and the popularity in the digital space have

gone hand in hand. This has resulted in a brisk revenue growth. In Japan, the concern

is that during the last couple of years, the trend is downward. There is no information available about China, due to the central role of the Baidu search engine

in the market.

Inbound links to Marimekko webpages

Geographical origin of inbound links to Marimekko webpages is

illustrated in the map below. At least China does not yet pop up with the weight corresponding to its value in

Marimekko's strategy, and also in the

United States the relative visibility is quite poor. In contrast, Finland and the

rest of North and Central Europe are relatively well represented.

|

| Inbound links to Marimekko webpages |

Marimekko in social media

The origin of Marimekko tweets are shown in the map below. The United States and Japan are by far the biggest tweeting countries - the number of tweets in these countries is, however, always large compared to smaller countries. Other notable countries, as regards to Marimekko related tweets, include Finland, Australia, Canada, United Kingdom and

Italy. There is a surprisingly weak popularity for example in Sweden, Denmark, Germany,

and France.

|

| Marimekko tweets by country |

Business by product lines

The

company business is divided into three product lines, Clothing, Interior decoration and Bags, see the picture on the right presenting their revenues. The numbers of 2013 are estimates.

The

company business is divided into three product lines, Clothing, Interior decoration and Bags, see the picture on the right presenting their revenues. The numbers of 2013 are estimates.

Digital footprint and marketing of the product lines can be

evaluated using Google search statistics. This is best done by comparing Marimekko related searches with suitable benchmarks.

|

| Marimekko searches vs. women´s clothing ones |

Women´s clothing is perhaps the most important segment of the Clothing product line. The trend of Marimekko searches has clearly fallen behind

women's clothing category that serves as a benchmark. The thick horizontal

line describes the zero-level development of searches and Marimekko's line is

a lighter blue, see the picture on the left. While Marimekko's Clothing sales has

recovered slightly after the drop that started in 2008, this does not seem to appear in the

digital popularity.

|

| Marimekko searches vs. home-making & interior decor ones |

Google searches of home-making and interior decor category are a good benchmark for Marimekko´s Interior decoration product line. Again, Marimekko has fared less well than the benchmark. Also the recent sales growth is not seen in Marimekko searches, compared with the benchmark.

|

| Google Marimekko searches vs. clothing accessory benchmark |

Clothing accessories category of Google searches are used to benchmark Marimekko´s Bags product line. The growth of the product line that started in 2010 was first visible also in search statistics, but after that Marimekko has fallen behind their benchmark.

Conclusions

It is clear that Marimekko are not effectively enough using available digital marketing tools alongside product portfolio renewal, expansion of retail and the brand. There is a risk that with changing consumer purchase behaviour, relying more and more on digital channels,

Marimekko´s relative competitiveness will suffer.

Marimekko is not visible enough on the Internet. The websites

are clearly not interesting enough, and the company messages do not reach other websites. In addition, in many major market areas, there are no company websites available in local languages. In social media, Marimekko is not sufficiently benefiting from word-of-mouth and the company websites are there not promoted enough.

The worrying thing is that Marimekko´s new stores and other major

investments in new market areas do not seem to get enough support from digital activities. Although some promising examples can be found, this means

inevitably only half-hearted success. All the three product lines seem to have a declining trend in the digital world compared with the benchmarks.

A briefcase is a great way to organize your documents on the go. There are several other great accessories to help with business organization. An electronic accessory such as PDA can keep all your business contacts organized and a to-do-list. mens briefcase

ReplyDeleteWe are offering Social media training courses in Bangalore with Live projects and social tools. Learn to increase your business awareness through various social media channels. Please visit our website to know more information.https://onlineidealab.com/social-media-marketing-course/

ReplyDeleteThat is amazing! I love this post and want to recommend you a beautiful service for essay and homework! This guys really know how to do it, and you will be so happy! Check time4writing login this and write to them write thesis for me and go for wins! Good luck and have fun!

ReplyDeleteI like this post, write my college paper ! If you need assistance, you can opt to use a research paper template or hire an expert to compose your thesis. Our custom research paper writing service is ready to tackle your thesis while you enjoy some you-time. However, whatever option you choose, both must follow a particular format.

ReplyDeleteIt will already become much better and easier for you if you have abstract specialists who will help you edits text, for example, write any written work for you, competently and efficiently

ReplyDeleteI can still recall working on my tablet in order to complete a college work that was due yesterday. My students were having a good time at the party while I was working on my project. The moment I realized I could complete this homework with business plan assignment ideas assistance, I got in touch with all of them and they agreed to help.

ReplyDeleteThanks for sharing this fantastic piece with us here; It’s actually a great and helpful piece of information. I am glad that you simply shared these interesting updates here with your visitors. unn jupeb admission form deadline

ReplyDeleteThank you for this brief explanation and this information. I really liked your blog. This is an informative topic. erp software in chennai

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThanks for writing thiss

ReplyDelete